georgia ad valorem tax trade in

The ballot measure would exempt timber equipment from ad valorem property taxes beginning on January 1 2023. Currently the ad valorem tax formula that applies to your vehicle depends on.

Tavt Information Georgia Automobile Dealers Association

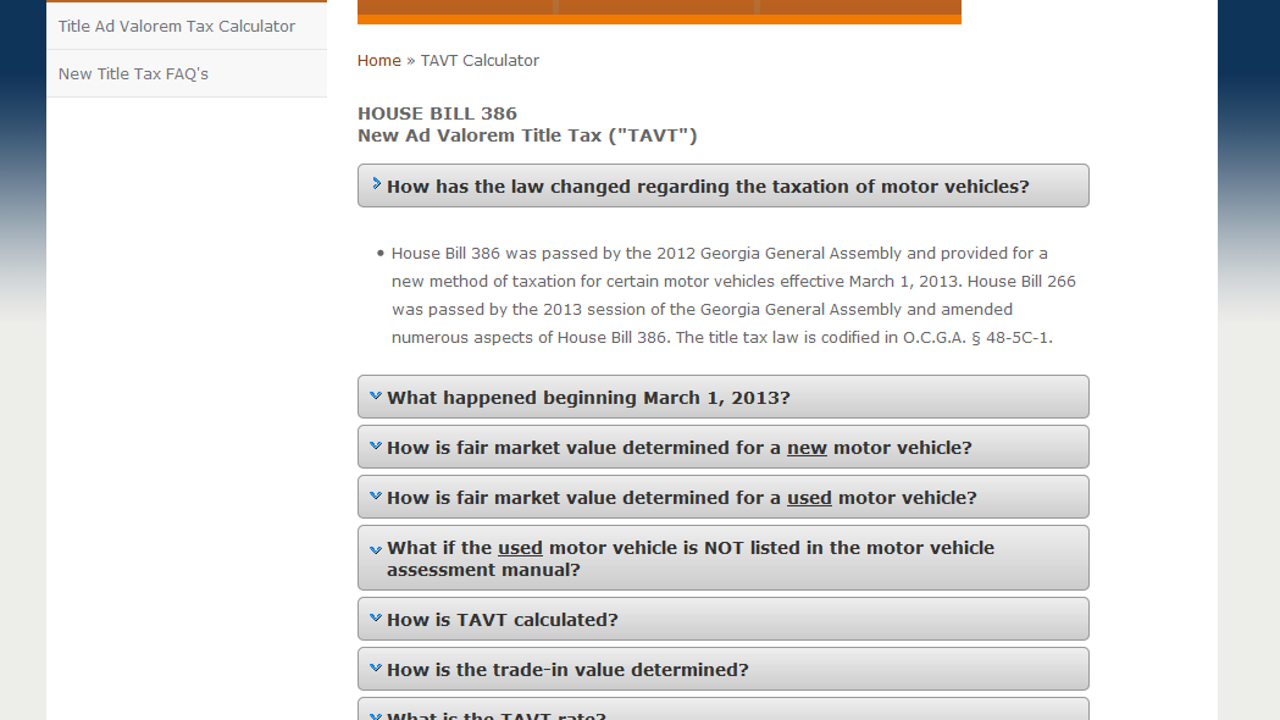

48-5C-1 effective March 1 2013 requires all Ad Valorem Tax to be paid on vehicles that require a title at the time of title application.

. Timber equipment to be exempted from taxes would include equipment. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed significantly.

If you qualify to opt in. In Georgia all-electric vehicles are required to pay a 21369 fee whether you have the Alternative Fuel Vehicle AFV plate or not. If the vehicle was purchased in Georgia between January 1 2012 and March 1 2013 and titled in this state the owner is eligible to opt into the new system.

There is a flat rate fee of 20 for all vehicle. The property taxes levied means the taxes. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and.

Everyone who owns a vehicle licensed in Georgia must pay ad valorem tax at the time of purchase. How much will my GA tag cost. Lets say I go to the Dealer down the road and have a specific car in mind.

If an owner believes the value is too high for the condition of their vehicle they may appeal the value to the County. If I purchase from the dealer I will only need to pay the reduced amount of TAVT Title Ad Valorem Tax - The. Georgia Title Attorney explains Ad Valorem Taxes Closing Prorations Property Tax Exemptions and the Georgia Property Tax Return.

These vehicles are exempt from sales and use tax. This calculator can estimate the tax due when you buy a vehicle. So the only added cost to getting the AFV plate.

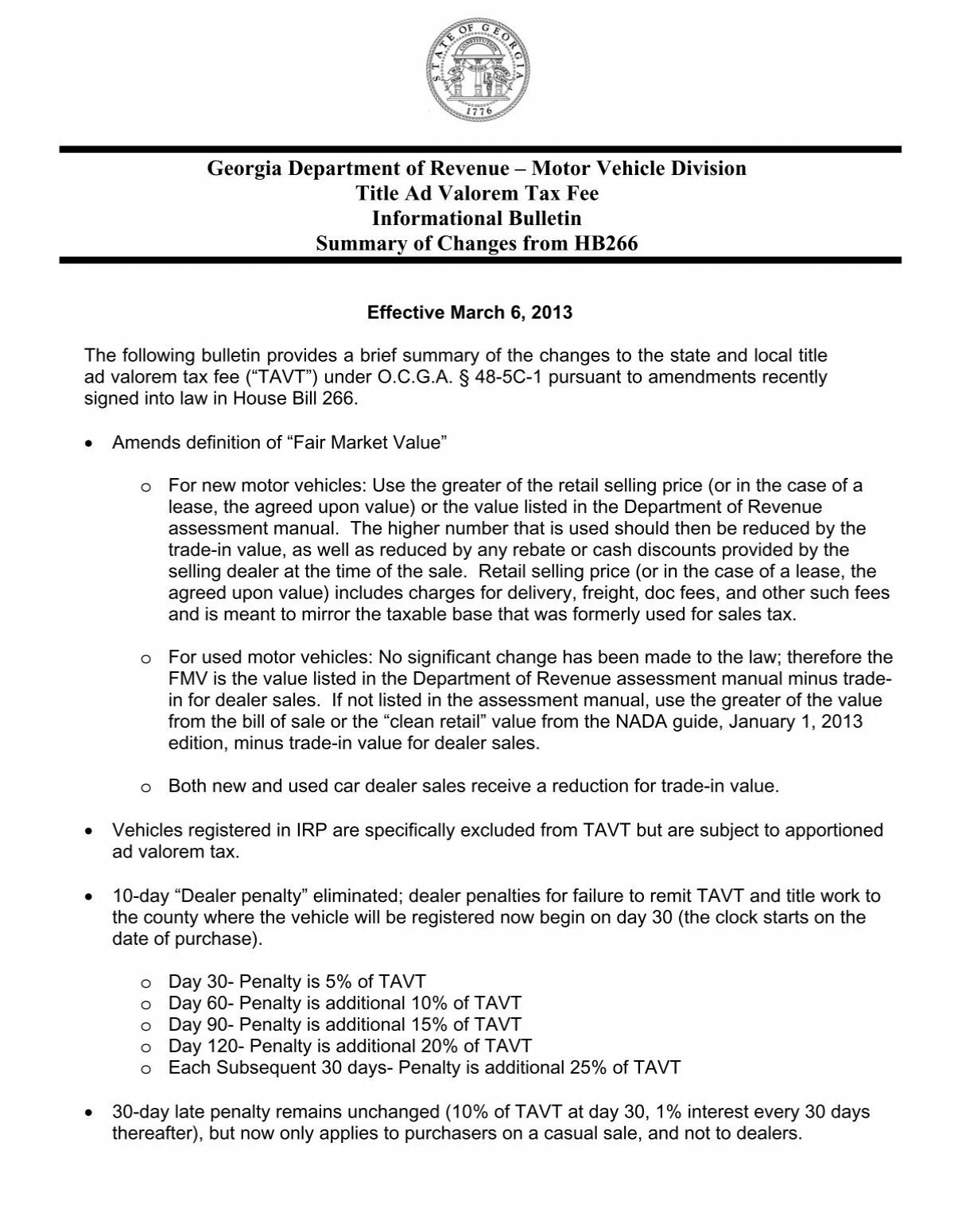

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. The family member who is titling the vehicle is. As a general rule Trade-in Value can be used to reduce the Fair Market Value of a motor vehicle for Title Ad Valorem Tax TAVT purposes when exchanged by the titled owner of a motor.

Vehicles purchased on or after March 1 2013. Ad valorem tax for state purposes will be due on the. What if I think that the title ad valorem tax assigned to my vehicle is too high.

Georgia has no sales tax on new used vehicles but it does have a Title Ad Valorem tax of 7. Carvana does not include this tax in its pricing and I am worried that they will force a contract. The good news is the TAVT will be applied after the trade-in value is deducted.

There is no sales tax in the state of GA but an Ad Valorem tax is paid when the car is registered. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. How Much Is Ad Valorem Tax In Georgia.

Solved Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia. For the answer to this question we consulted the Georgia Department of Revenue. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system.

If an owner believes the value is too high for the condition of their vehicle they may appeal the value to the County. Generally any motor vehicle purchased on or after March 1 2013 and titled in Georgia is. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

What if I think that the title ad valorem tax assigned to my vehicle is too high. In Georgia the trade-in value of your car will be deducted from the price of your new car. In the state of Georgia individuals who own a motor vehicle are required to pay a one-time ad valorem tax commonly referred to as the title ad valorem tax fee or TAVT.

Mayor Advises On Property Assessment Appeals

Auto Dealers Can Manipulate Car Prices Through Tavt Local News Valdostadailytimes Com

Tax Commissioner S Office Cherokee County Georgia

![]()

Car Sales Tax In Georgia Explained And Calculator Getjerry Com

Georgia Sales Tax Small Business Guide Truic

Construction Contractors Georgia Sales And Use Tax Obligations Litwin Law

How Much Are Tax Title And License Fees In Georgia Langdale Ford

![]()

Georgia New Car Sales Tax Calculator

Georgia Title Ad Valorem Tax Updated Youtube

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

Vehicle Taxes Dekalb Tax Commissioner

Vehicle Taxes Dekalb Tax Commissioner

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Property Taxes By County Interactive Map Tax Foundation

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Car Tax By State Usa Manual Car Sales Tax Calculator

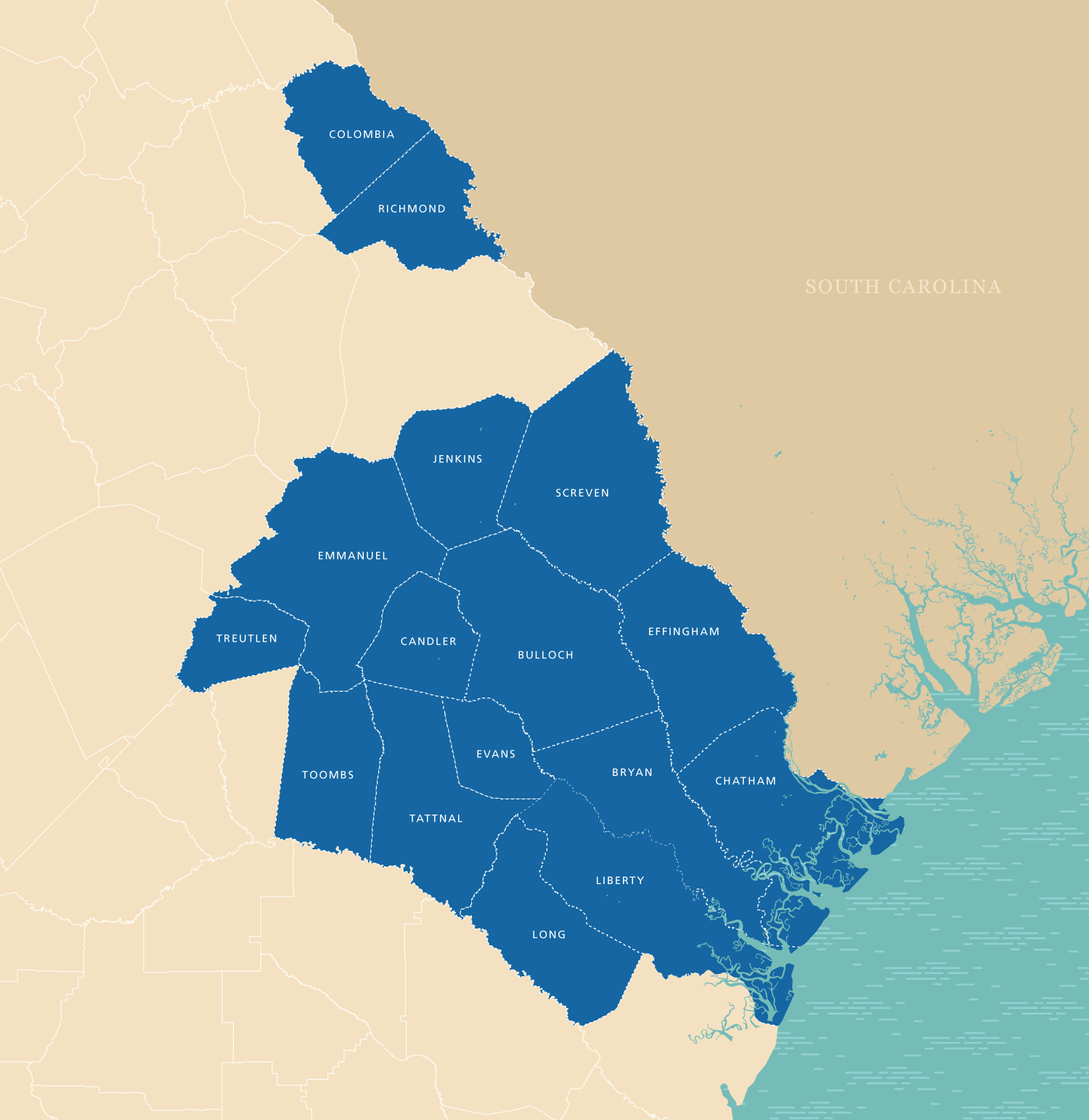

Business Tax Advantages Savannah Ga Business Tax Incentives Ga